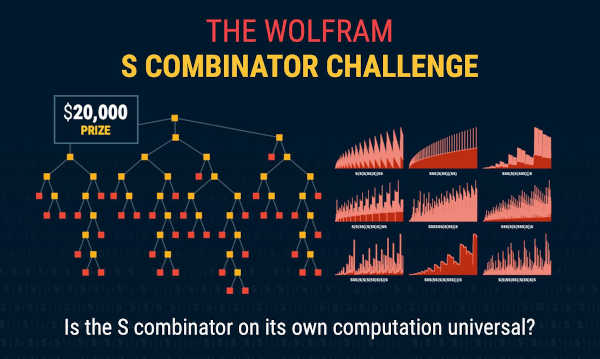

Wolfram offers $ 20,000 as evidence

In the past, Stephen Wolfram has awarded prizes for evidence consistent with his particular way…

In the past, Stephen Wolfram has awarded prizes for evidence consistent with his particular way…

Parallel computing has emerged as a significant and influential technology in various sectors, including the…

Parallel computing has gained significant attention in recent years due to its ability to enhance…

Parallel computing has become an essential tool in various fields, including finance. The ability to…

The landscape of parallel finance has witnessed significant growth in recent years, with the advent…

Parallel computing has emerged as a powerful solution to address the ever-increasing demands for processing…

MapReduce is a widely used parallel computing model that aims to efficiently process large-scale datasets…

Threads in Parallel Computing: Shared Memory Systems In the field of parallel computing, shared memory…

Cloud computing has revolutionized the way computational tasks are performed by harnessing the power of…

Parallel computing has become increasingly essential in modern computational systems, enabling the execution of multiple…

The field of financial modeling has undergone significant advancements in recent years, propelled by the…

Parallel computing has emerged as a crucial field in computer science, facilitating the execution of…

Parallel computing has become an essential approach in addressing the increasing demands for computational power…

In the era of big data and complex computing tasks, parallel computing has emerged as…

High-performance computing (HPC) has emerged as a critical field in the realm of computer science,…

Distributed memory systems play a crucial role in parallel computing, enabling efficient processing of large…

Distributed computing, a key component of parallel computing, has revolutionized the field of information technology…

Cluster computing is a powerful technique used to enhance the performance and scalability of computer…

Data analysis plays a crucial role in various fields, including finance. With the rapid advancements…

Data parallelism is a crucial concept in the field of cluster computing, enabling efficient processing…

The increasing demand for processing large-scale data and solving complex computational problems has led to…

Fault tolerance is a critical aspect in parallel computing, particularly in the context of cluster…

Parallel computing has become an essential approach to solving computationally intensive problems efficiently. One popular…

Cache coherence is a critical aspect of parallel computing, particularly in shared memory systems. In…

Cluster computing has emerged as a powerful and widely adopted approach in the field of…

Grid computing has emerged as a powerful paradigm for solving complex computational problems by harnessing…

Parallel computing is a fundamental aspect of modern computer science, enabling the effective utilization of…

A Spotlight on Parallel Finance Parallel computing has emerged as a crucial tool in optimizing…

Fog computing, an emerging paradigm in the field of parallel computing, has gained significant attention…

Parallel computing has emerged as a crucial approach to effectively handle complex computational tasks in…

Parallel computing has revolutionized the field of finance, providing novel approaches to address complex computational…

Shared memory systems play a crucial role in the field of parallel computing, enabling multiple…

Memory management plays a vital role in parallel computing, particularly in shared memory systems. Efficiently…

Big data processing has become a critical aspect of modern computing, as the volume and…

Edge computing, a paradigm that pushes computational resources closer to the network edge, has gained…

Parallel computing has emerged as a powerful approach to enhance the performance and efficiency of…